how to lower property taxes in maryland

The credit caps property taxes based on income level. For more information please call 410-996-2760 or email at sdatperspropmarylandgov.

Living In Maryland Vs Virginia Vs Dc Area The Lifestyle Battle

Responsibility for the assessment of all personal.

. One of the most efficient methods is the property tax appeal. Limit Home Improvement Projects. Tax rates are set by the County Council each fiscal year.

Research Neighboring Home Values. How Can I Lower My Property Tax Assessment in Maryland. If you wish to learn how.

See If You Qualify For Tax. THIRD APPEAL - MARYLAND TAX COURT. The rates are based on 100 of assessed.

Your local tax collectors office sends you your property tax bill which is based on this assessment. This detailed report tells you everything you need to know about reduc. For more information call the Maryland Tax Credits Telephone Service at 410-767-4433 or 1-800-944-7403 or visit the Maryland Tax Credit Programs and Exemption.

How can I lower my property taxes. This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland. In order to come up with your tax bill your tax office multiplies the tax rate by.

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula. This detailed report tells you everything you need to know about reduc. Only households with a total gross income of less than 60000.

So if a propertys market value is determined to be 100000 and the assessment ratio is 80 percent the assessed value for property tax purposes would be 80000. The most common ways to reduce your property tax liability are avoiding home improvement projects making sure your tax bill is. This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland.

They include senior and homestead exemptions. 0 of the first 8000 of the combined household. If you are dissatisfied with the decision made by the Property Tax Assessment Appeals Board you have the option to file an appeal to the Maryland.

Learning about actions that can help you reduce property taxes is necessary for every property owner. See If You Qualify For Tax. Limit Home Improvement Projects.

Research Neighboring Home Values. In Maryland there is a tax on business owned personal property which is imposed and collected by the local governments. Exemptions can reduce the amount of Maryland property taxes.

How To Lower Property Taxes. Property Tax Exemption- Disabled Veterans and Surviving Spouses. Our example will use a typical county rate of 100 per 100 of assessment and a state.

How To Lower Property Taxes. How can I lower my property taxes. Thus for illustration purposes only the county and state property tax rates will be considered here.

Armed Services veterans with a permanent and total service connected disability rated 100 by the Veterans Administration. Another important tax credit is the Homeowners Property Tax Credit. However they dont apply to levies and special taxes.

The Homeowners Property Tax Credit Program Circuit Breaker is the largest and most important program in that it provides annual property tax credits to homeowners who qualify.

New Jersey Education Aid How Maryland Does It How Another Deep Blue State Has Much Lower Property Taxes Than New Jersey

Maryland Sales Tax Handbook 2022

New Jersey Education Aid How Maryland Does It How Another Deep Blue State Has Much Lower Property Taxes Than New Jersey

New Maryland Considers Tax Rate Cut Tj News

Property Taxes By County Interactive Map Tax Foundation

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

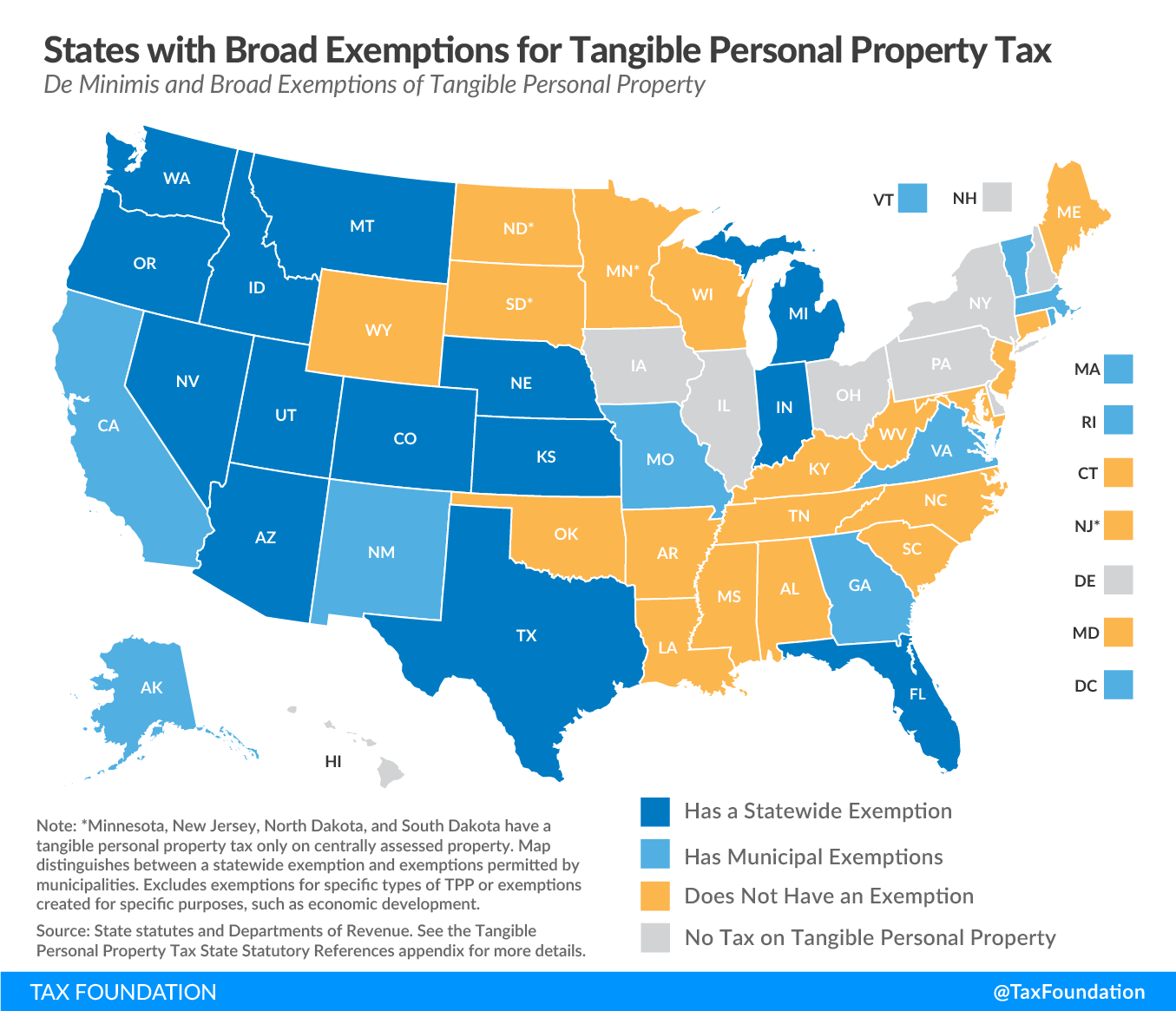

Tangible Personal Property State Tangible Personal Property Taxes

Maryland Property Taxes By County 2022

What Can Maryland Do If I Owe Taxes

17385 Eagle Harbor Rd Aquasco Md 20608 15 Ac With Approved Perk Building Site Loopnet

Cut Maryland Sales Tax 2 Cents Cut Md Sales Tax 2 Cents

Texas Voters Will Decide Whether To Lower Some Property Tax Bills In May Election Kera News

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Property Tax Credits Are You Eligible City Of Takoma Park

Office Of The State Tax Sale Ombudsman

Floyd Company Maryland Property Tax Reduction Specialists

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

Property Taxes By State County Lowest Property Taxes In The Us Mapped